Kisan Credit Card 2021 [Online Apply] List, Application Status, Helpline Number: KCC (किसान क्रेडिट कार्ड योजना) scheme is an innovative scheme of Government of India to help the farmers of the country. Farmers are issued Kisan Credit Card so that they can easily avail of KCC loan from any of the banks at low-interest rates for meeting their agricultural needs. The interest in the KCC loan can be as low as 4%.

An Overview of KCC 2021

| Scheme | Kisan Credit Card (KCC) किसान क्रेडिट कार्ड योजना |

| Year | 2021 |

| Concerned Department | Department of Agriculture, Cooperation & Farmers Welfare, Ministry of Agriculture & Farmers Welfare, Govt. of India |

| Launch date | 14th August 1998 |

| Beneficiary | Farmers |

| Purpose | Bank loan for agriculture |

| KCC Validity | 5 years |

| Official website | https://pmkisan.gov.in/ http://www.agricoop.gov.in/ |

| RBI Corona Relief Package duration | 1st March to 31st May 2020 |

| KCC Application form | Click Here |

Kisan Credit Card Yojana 2021

Under this Corona relief package of RBI, farmers whose repayment is falling under the time period between1st March 2020 and 31st May 2020 can skip the payment if they wish. For more information, all the farmers required to contact their concerned bank. It is not mandatory, if any farmer is able to pay can pay it off. This relief has been provided on the following types of bank loan payments-

- Bullet repayments

- Credit Card Statements

- Principal and/or interest components

- EMIs (Equated Monthly Installment)

Citizens should note that RBI has only provided interim relief to defer the payment of interest for three months and therefore it does not implies that interest on Kisan Credit Card will be waived. After the said date, all farmers and other people have to repay the loan.

Here we have shared all the necessary details which you need to know about the Kisan Credit Card. Just go through the post and collect details on what is KCC, its benefits, updates, how to apply for it, the document required, and all information relevant to it.

Objective of a Kisan Credit Card

Being an agriculture prime country, India has about 159.7 million hectares of agricultural land which is second in the world after the U.S.A. To avail maximum benefits from this agricultural land the government announces various schemes and subsidies. The major announcement was the PM Samman Nidhi Scheme which was introduced to provide financial assistance to the farmers of the country. The important announcement under the PM Kisan scheme is the Kisan Credit Card scheme.

The Kisan credit card provides is also a financial aid providing scheme. The main objective of the Kisan credit card scheme is to provide a credit card to the farmers so that they do not have to knock on the bank doors for buying agricultural equipment. Through a credit card, farmers can also avail of bank loans at a very low interest. The procedure for obtaining the credit card is simple and it can be availed by following the simple steps provided below.

Kisan Credit Card Benefits

The KCC/Kisan Credit Card has huge benefits for the farmers availing the scheme. The scheme will be available in several banks and the applicants can avail the scheme easily. Some of the important benefits of the Kisan Credit Card 2021 are depicted below.

- After the release of CSC centers, it has now become easier to avail the services provided by the Government. The applicants can avail themselves of the services by visiting the nearby CSC centers.

- The interest rates for which the loan is given are very low. Therefore, the farmers can earn more profit through the loans granted by the Government.

- The limit of credit in the Kisan Credit Card can also be increased. If you have a good CIBIL Score, you can easily apply for increasing the credit limit.

- Along with the credit facility, the farmers also get additional crop insurance for which the loan is taken. The crop insurance covers all major crops in it.

- The applicants can also avail of various other services of the banks as after getting the credit card they will be a registered customer of the bank.

- The services can also be accessed through the mobile application. Almost every bank has provided online applications.

किसान क्रेडिट कार्ड योजना 2021

KCC scheme was launched on 14th August 1998 and the model of this scheme was formed by the National Bank for Agriculture and Rural Development (NABARD). This scheme was launched with an aim to provide credit support to the farmers so that they can get financial support to meet their agricultural needs. Farmers involved in Agriculture, Fisheries, and Animal Husbandry are included under this scheme. Under this scheme, short term loan for crops and term loan is provided.

Through the Kisan Credit Card Scheme, the authority will provide the beneficiaries with a very low-interest rate. The process of availing of the loan is very simple. Applicants must note that the loan under KCC is provided at an Interest rate of 9%. On these interest rates, the government provides an additional subsidy of 2% which results to be 7%. After this, the applicants repaying the loan in the prescribed schedule will be returned with 3% of the interest amount which will finally cost up to 4%.

In simple words, it can be stated that the applicant who maintains a good record in submitting the monthly installment will be provided with a waiver of 3%. Therefore, the final interest rate on which the beneficiary will get the loan is 4%.

The two types of credit is offered under this scheme i.e. Cash Credit and Term Credit (It is provided for allied activities like- land development, drip irrigation, pump sets, plantation, etc.). Since the launch of the KCC scheme, the government has made many revisions to it. The validity of a KCC is 5 years.

Importance of Kisan Credit Card

- Using Kisan credit cards, farmers can take loans from banks on low interest rates.

- KCC holders do not have to apply for loans separately for each crop.

- With the help of KCC farmers can purchase seeds, agriculture equipment, fertilizers, and other assets of farming and agriculture.

- It is also helpful in reducing farmer’s debt burden.

किसान क्रेडिट कार्ड Eligibility Requirements

Kisan Credit Card is only issued to the farmers who fulfils the eligibility criteria as prescribed by the authorities. Those who wish to apply for KCC can go through eligibility requirements shared as under-

- People who are landowners cum cultivators

- All the farmers are individual borrowers or Joint borrowers of cultivated land and are involved in farming or allied activities like animal husbandry and fisheries.

- Self Help Groups (SHG)/ Joint Liability Groups (which also includes sharecroppers or tenant farmers)

- All the tenant farmers, oral lessees & sharecroppers, etc.

- The farmers should be residing under the operational areas of the bank.

Document Required to get Kisan Credit Card

At the time of application for KCC, applicant farmers are required to provide following documents-

- Duly filled-in KCC application form

- Any of the following id proof- Aadhaar Card, Voter ID card/ Driving License / PAN card / Passport, etc.

- Any of the following Id proof- Voter ID card / Aadhaar card / Driving license/ Passport etc.

- Passport-sized photograph of the applicant

- Land documents

- Other documents as prescribed by the bank.

Without valid documents, no Kisan credit card will be issued to the farmers.

Kisan Credit Card Scheme Uttar Pradesh Target

Under the scheme the government aims to grant financial assistance through providing Kisan Credit Card to the farmers. The authority aims to grant KCC to more than 100000 farmers. Through the KCC applicants can easily avail loans at low interest rates. To make each section of the agricultural sector more efficient, the authority has planned to achieve the below given target.

| District names | Credit Card |

| Aligarh Division | 2187 |

| Agra Division | 2863 |

| Azamgarh Division | 10148 |

| Prayagraj Division | 7758 |

| Kanpur Division | 5703 |

| Gorakhpur Division | 10349 |

| Chitrakoot Division | 4096 |

| Jhansi division | 3321 |

| Devipatan mandal | 2811 |

| Ayodhya Division | 8239 |

| Bareilly Division | 3097 |

| Colony board | 3701 |

| Meerut Division | 4552 |

| Moradabad Division | 8409 |

| Varanasi Division | 5254 |

| School of education | 3888 |

| Saharanpur Division | 1494 |

| Lucknow Division | 12130 |

Kisan Credit Card Indian Bank

KCC is offered by the private and public sector banks across the country. Farmers who wish to apply for KCC can visit any of the bank as per their convenience.

All the public sector banks provide KCC to eligible farmers, and these banks include–

- National Payments Corporation of India (NPCI)

- National Bank for Agriculture and Rural Development (NABARD)

- State Bank of India (SBI)

- Industrial Development Bank of India (IDBI)

- Cooperative banks

THE INDIAN BANK ASSOCIAITION की तरफ से जारी की गयी एडवाइजरी के ज़रिये सभी बैंको को यह निर्देश दिए गए है की किसान क्रेडिट कार्ड, क़र्ज़ माफ़ी से जुड़े सभी सर्विसेज पर छूठ दी जाए।

Also, have a look at the names of the some of the Kisan credit card indian bank private and government bank offering KCC given below-

- State Bank of India

- Bank Of India

- ICICI Bank

- PNB

- Axis Bank

- HDFC Bank

- Indian Overseas Bank

- Odisha Gramya Bank

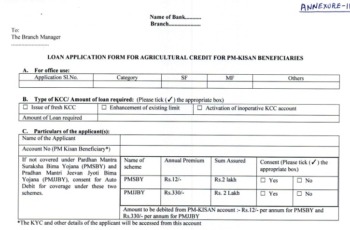

KCC Yojana Online Apply through PM Kisan Portal

In order to kisan card apply online, farmers can follow the simple instructions shared below-

- Visit the official website of PM Kisan i.e. https://pmkisan.gov.in/.

- On the homepage, click on the “Download KCC Form” tab.

- PDF form of KCC application form will appear.

- Print the application form.

- Fill in the required details in the application form.

- Attach all the necessary documents and visit the concerned bank.

- After completing all the formalities, the bank will issue a Kisan credit card and on the basis of which the farmer can apply for a loan.

Apart from PM Kisan portal, farmers can also avail the KCC application form from http://www.agricoop.gov.in/ or directly from the bank.

KCC: How to Apply for Kisan Credit Card Online

- You need to visit the online website of the respective Bank you want to apply to.

- Look for the loans option on the home page and then search ‘Apply for KCC’

- Now application form will open, read and fill in the details correctly.

- Click submit button

- You will get an application reference number.

- Save the reference number for future reference.

KCC Links of Top Banks

| Bank Name | KCC Loan Official Link |

| Axis Bank | Click Here |

| ICICI Bank | Click Here |

| Punjab National Bank | Click Here |

| Bank of Baroda | Click Here |

| Andhra Bank | Click Here |

| Allahabad Bank | Click Here |

| Odisha Gramya Bank | Click Here |

| Sarva Haryana Gramin Bank | Click Here |

| Canara Bank | Click Here |

| HDFC Bank | Click Here |

| Bank of Maharashtra | Click Here |

| State Bank of India | Click Here |

KCC Insurance for farmers

KCC provides personal accident insurance coverage up to Rs. 50,000 For death. And in case of accident resulting in disability Rs. 25,000

Kisan Credit Card Helpline Number

Toll-Free – 1800 115 526

Tolled Helpline Number – 0120-6025109/155261

Help desk Email address – pmkisan-ict@gov.in

Hello Friends, I am from India. After earning my Graduate degree in Computer Application, I decided to pursue my passion for Web Designing and Content Writing. My ultimate goal is to become one of the best in my field and continue to deliver high-quality content. Further, I aim to deliver the latest information regarding recruitment to job seekers, the latest news with accuracy, which shall benefit them in every way possible.